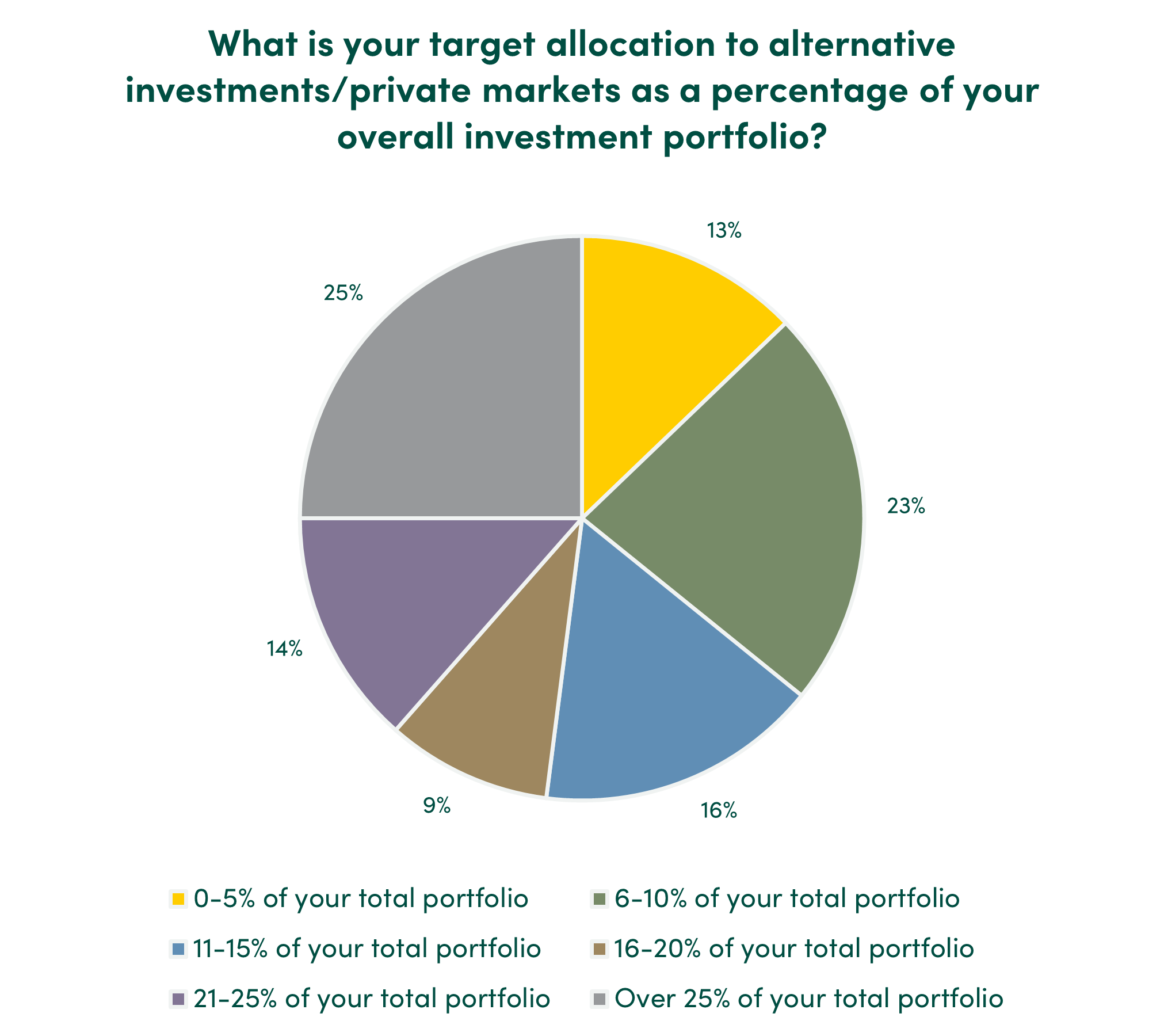

- Connection Capital research shows 2/3 target an allocation to private markets of over 10% of their investment portfolio, with 4 in 10 targeting over 20% - consistent with prior years’ research.

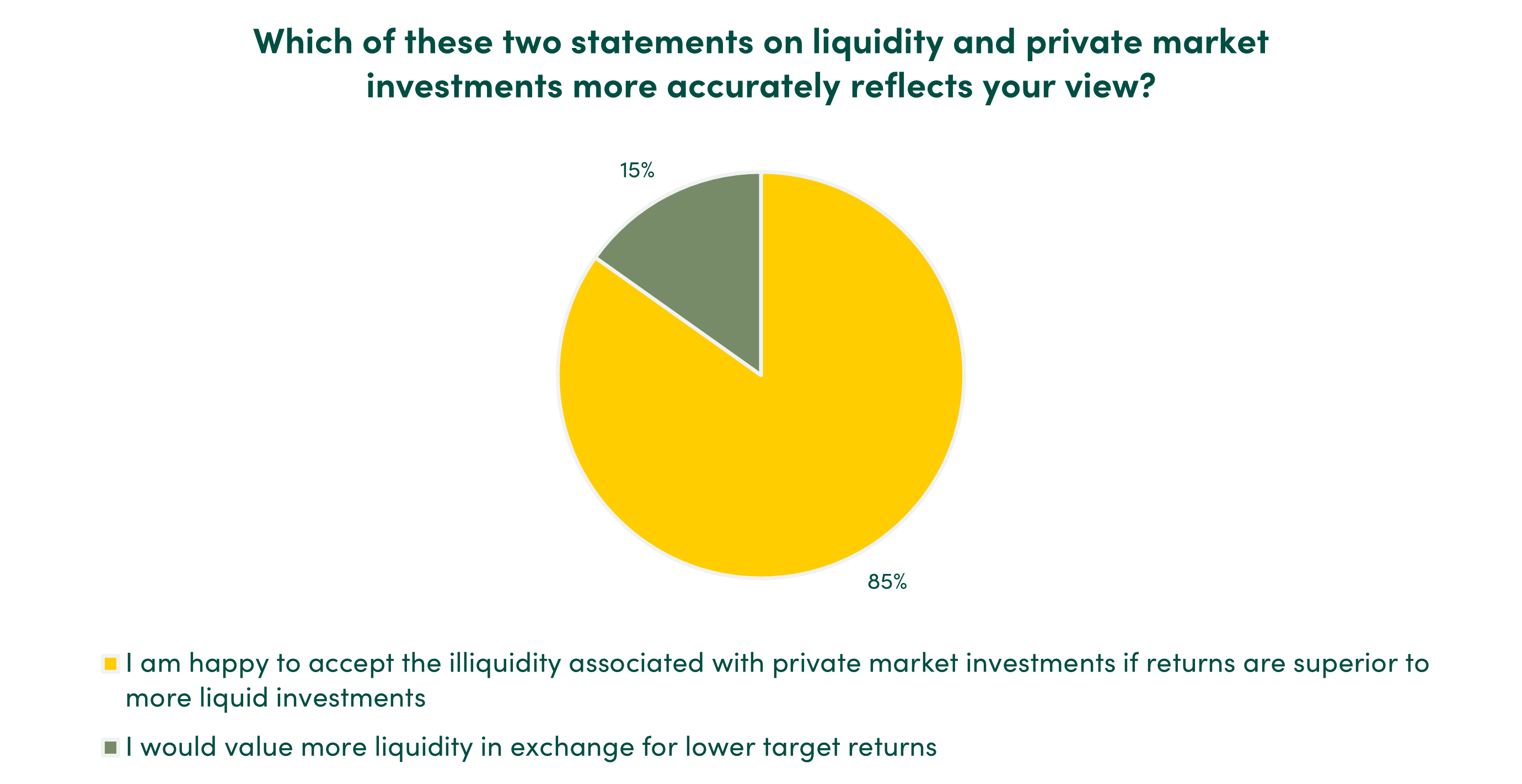

- No liquidity concerns about private market strategies, as long as returns outperform.

UK private markets and alternative investment platform Connection Capital has published research showing continued strong appetite for private market investments from ultra high net worth (UHNW) and high net worth (HNW) investors despite a backdrop of reduced exits across markets.

The results of Connection Capital’s annual Alternative Investments survey1, conducted across its client base of predominantly UK-based UHNWs/HNWs, show that 2/3 target an allocation to private markets of over 10% of their investment portfolio; 4 in 10 target an allocation to private markets of over 20%; and 1 in 4 allocate over 25%. The results are consistent with those of previous years’ surveys - a clear signal of how embedded private markets have become in UHNW/HNW portfolios.

Targeting higher returns than those available in public markets is cited by most (78%) as the main reason for allocating to private markets.

Single asset private equity investments and co-investments are the most in-demand private market asset class, with 94% of respondents likely to consider an investment over the next 12 months, followed by private equity growth funds (82%) and buyout funds (77%). More than 2/3 of respondents indicate an appetite for private equity secondaries.

While most investors (54%) expect to maintain their current allocation levels to private equity over the next 12 months, almost a quarter plan to increase it – suggesting a steady flow of capital into the asset class despite market uncertainty.

No private market liquidity concerns, as long as returns outperform

Despite the recent proliferation of semi-liquid funds, the survey results indicate that UHNW/HNW investors are cognisant and happy to accept the illiquidity associated with private market investments if returns are superior to more liquid investments (85% agreement) versus 15% stating “I would value more liquidity in exchange for lower target returns”.

Claire Madden, Co-Founder and Managing Partner at Connection Capital, commented:

“Even in the face of political change and global volatility, private equity continues to shine for our investor base. With the right access and due diligence, clients see the potential to outperform, and are prepared to commit significant capital accordingly.”

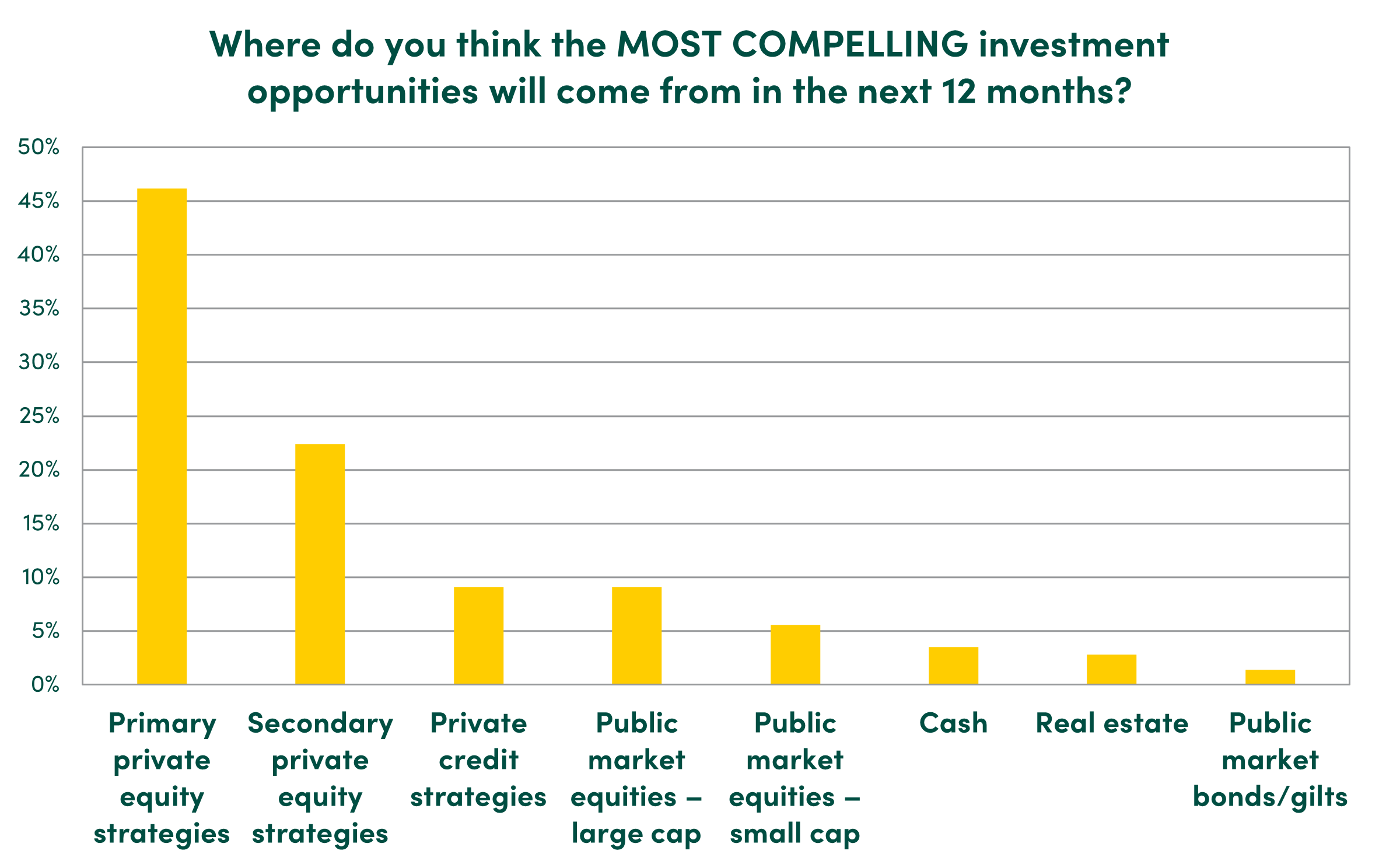

Primary private equity seen as most compelling opportunity across all markets

When asked where they saw the most compelling investment opportunities across both public and private markets, respondents pointed overwhelmingly to private equity – particularly primary strategies (46%) – ahead of other private market strategies and 3x more than public market asset classes (15%).

UK and Europe favoured as US unpredictability clouds outlook

Investors identified Europe (31%) and the UK (25%) as the most compelling regions for investment in the coming year. In contrast, continued economic and political unpredictability in the US is having a clear dampening effect on investor sentiment with only 20% of investors declaring it the most compelling region.

Government tax policy impact under the spotlight

The prospect of capital gains tax (CGT) reform continues to shape investor behaviour. If CGT is brought in line with income tax, 43% of respondents say they would consider reducing their exposure to equities (public and private) altogether, while a small proportion (7%) say they might cease equity investment entirely. However, the majority – 57% – said they would not change their investment behaviour.

Claire added:

“Policymakers should take note: private investors are vital to the UK economy, particularly to SMEs that may not have access to institutional capital. Private equity plays a major role supporting business growth, job creation, and innovation across the UK. Any changes to the tax environment must carefully weigh the potential impact on this flow of private capital.”

<ENDS>

About Connection Capital

Connection Capital provides private professional investors with access to direct private equity and debt transactions and private market alternative investment funds that are usually only available to institutional investors.

It has raised c.£550 million of funds (as at 31 March 2025), from its clients, which has been invested across a diverse portfolio including Virgin Wines, Tempcover, Crosta & Mollica, Winder Power, and Starbucks franchisee, 23.5 Degrees, as well as private market fund strategies operated by institutional-grade managers such as CVC, Epiris, AlpInvest, and Five Arrows.

Investment opportunities are identified and negotiated by Connection Capital, which also carries out all due diligence and manages the investment from completion through to exit, on its clients’ behalf. Connection Capital is authorised and regulated by the Financial Conduct Authority.

Press enquiries:

Claire Madden, Managing Partner, Connection Capital

020 3696 4010 or 07764 241476

Russell O’Connor, Headlines for Business

07760 282586