We’re seeing a marked increase in high-quality co-investment opportunities coming from managers of all sizes, and there are three key factors driving this trend.

One is that rising interest rates are making debt more expensive, while banks are being more cautious about their lending, increasing managers’ need for extra equity capital.

Yet at the same time, it’s a difficult fundraising landscape, where many institutional investors are flocking to the biggest managers in a flight to perceived safety, leaving many other well-regarded managers struggling to meet their fundraising targets. In order not to be left out of the market, they are turning to co-investors so that they can stick to their strategies, maintain their target acquisition sizes and ensure they can create balanced portfolios.

Then there is the rise of continuation vehicles, due to the sizeable fall in valuations in public markets feeding through into private ones. Fund managers may be loath to sell flagship assets right now and so want to hold them for longer, but many fund investors are clamouring for liquidity as they seek to rebalance portfolios put out of kilter by falling public asset valuations altering their allocation profiles. New investors are therefore required to step in and take their place.

The upshot of all this is that there are plenty of single-asset co-investment opportunities out there, being offered to investors on more favourable terms. The availability of deals is a boon – but there are other sound reasons why now is a good time to consider co-investments.

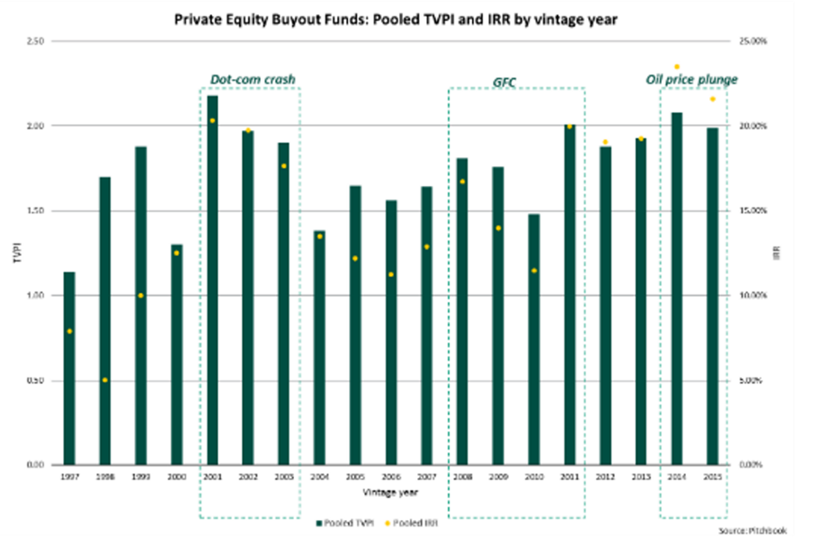

There are bound to be understandable reservations about investing during today’s challenging economic conditions, and it certainly pays to be selective. However, there’s evidence that investments made during periods of dislocation consistently outperform. Data from Pitchbook shows this happening after the dotcom crash in 2001, the financial crisis in 2008 and the oil price plunge in 2014 (see graph).

Source: Pitchbook

After all, the environment in which these investments will be exited will look very different from the one we’re in now. For single asset deals, you’re typically looking at a four-to-six year hold period, so by investing when valuations are down and looking for long-term success potential, there’s a very good chance of generating outsize returns when the recovery gathers pace.

With that in mind, it’s more important to put capital to work in order not to miss out on the upside, than to try to time the bottom of the market – something that’s incredibly difficult to do. It’s about investing when prices are low in companies with good growth prospects. Those that wait for the optimum moment may find that their chance has gone.