Private companies are taking longer to go public. The median age at which a company goes public increased from 6.9 years in 2014 to 10.7 years old in 20241.

As companies stay private for longer, investors without access risk missing out on high-growth stage investment opportunities. This can be evidenced when comparing public and private market performance.

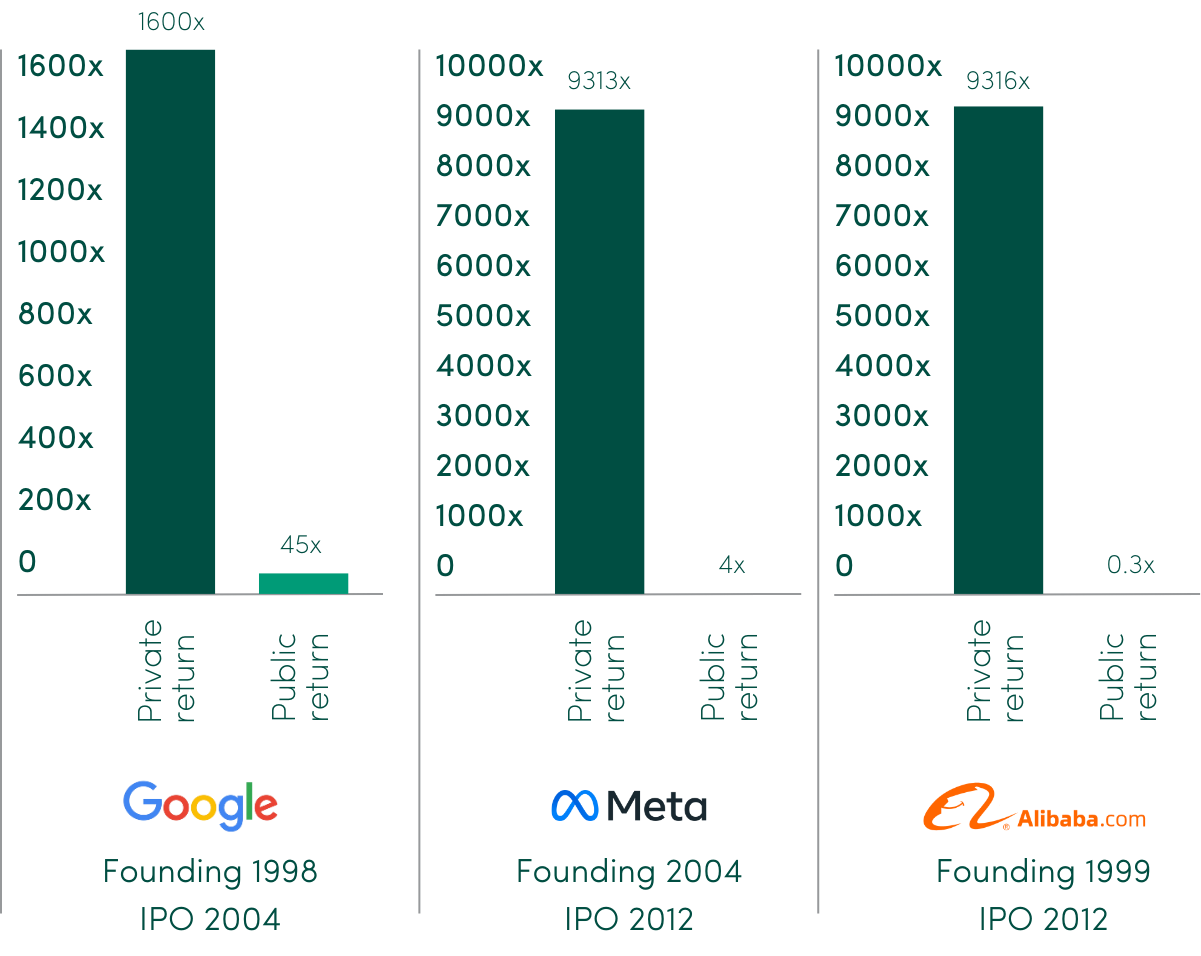

Data from alternatives manager Hamilton Lane shows that private equity and private credit have outperformed global public equity and credit markets, respectively, in 21 of the last 22 years2. It also highlights how public returns are dwarfed by private returns, using tech IPOs as an example.

Of course, tech companies are a narrow focus, but many of the reasons that companies are staying private for longer (see below) are shared by high-growth companies in other sectors too.

Why are companies staying private for longer?

There are multiple reasons why companies are staying private for longer. The main one is that the evolution of private markets means public markets no longer offer as stark a benefit to companies looking to grow as they previously did.

Historically, one of the main reasons for ‘going public’ was to create liquidity for shareholders and raise capital for future growth. Private markets have grown to such an extent that both can now feasibly be achieved without obtaining a stock market listing.

For example, global private equity assets under management (AUM) were estimated at c.$5.3 trillion in 2020 (doubling in size over five previous years)3, $13 trillion in 2024 - with growth to more than $20 trillion estimated by 20304.

Alongside this whopping AUM growth, strategies and investor appetites have evolved too, with the secondary trading market growing exponentially and providing liquidity opportunities for those looking to sell. Record volumes of more than $70bn were witnessed in the first half of 2024, removing one of the core advantages that public markets offer5.

While public markets undoubtedly continue to offer more regular liquidity than private companies, there are constraints placed on companies that wish to list. The costs, disclosures and governance related to being a public market company can dissuade management teams, especially if they are able to raise capital from private markets. And if the capital is available to them in private markets, then why would they bother with the headaches of public markets?

How does companies staying private for longer impact investors?

Public market companies have historically been the mainstay of global equity portfolios and with good reason. The governance required can help to ensure accountability and protect a wide range of investors with different levels of sophistication and needs.

But as companies stay private for longer, investor portfolios which are purely exposed to public markets risk missing out significant growth and value creation.

It’s worth labouring the point that the vast majority of companies are private. In the UK, 95% of the 5.35 million companies registered are private6, yet investors’ portfolios tend to be concentrated on the other 5%.

In addition, the performance of public markets is heavily correlated with the performance of a small number of companies – the magnificent seven (Microsoft, Nvidia, Google/Alphabet, Meta, Amazon, Tesla and Apple) who account for 32% of the S&P 500 (March 2025). This correlation and concentration has been evident in the volatility experienced in the aftermath of President Trump’s tariff announcements on 2 April 2025.

Investors with only public market exposures are not only missing out on growth—they’re missing out on much needed diversification too.

How to invest in growth companies?

The trend of companies staying private for longer means investors who have the capacity and the appetite for high-risk investments, should consider private market investments to target growth. That’s easy to say, but more difficult to execute on in practice with both access and availability of information (relative to public companies) presenting challenges to investors.

There are now many investment platforms available which can provide access to private market investments, either single asset direct investments or through funds operated by third party managers.

At Connection Capital, we offer direct investment opportunities in established UK private companies, focusing on UK SMEs. We conduct due diligence and provide professional investors with a detailed investment proposal on each opportunity.

We also provide access to private equity buyout funds and diverse portfolios of private companies, across different sectors and geographies.

What are the future trends in private markets?

We believe the trend of companies staying private for longer will continue and private markets will maintain their rapid growth. Investors will seek a much broader mix of public and private market investments than before, motivated by higher potential returns, product innovation, and an increasing awareness of alternative asset classes and their features.

Given the volatility in public markets, we see this as a positive trend. But it will require those investing in private growth companies to have a firm understanding of the key differences and the risks involved.

If you’d like to find out more, we’re happy to help.

Please note:

Past performance is not a reliable indicator of future performance. Investments in venture capital are high risk and speculative which means there is no guarantee of returns and investors should not invest unless they are prepared to lose all of their money. This type of investment is illiquid so can’t be easily accessed until the exit point. The investor is unlikely to be protected if something goes wrong. More information is given on our risk warnings page here.

Sources:

- Morningstar:

https://indexes.morningstar.com/insights/analysis/blt81d5614b4c2ccd2b/unicorns-and-the-growth-of-private-markets - Hamilton Lane:

https://hamiltonlane.maglr.com/a-guide-to-private-markets/why-should-investors-consider-private-markets-in-their-portfolio - The Future is Private: Unlocking the Art of Private Equity in Wealth Management, Boston Consulting Group.

- Blackrock:

https://www.blackrock.com/institutions/en-us/insights/private-markets-outlook - FT Adviser:

https://www.ftadviser.com/investments/2024/10/03/rapid-modernisation-seeing-private-markets-growth-boom/ - Gov.uk:

https://www.gov.uk/government/statistics/companies-register-activities-statistical-release-april-2023-to-march-2024/companies-register-activities-april-2023-to-march-2024