Creating a diverse investment portfolio relies on investing in a variety of underlying asset classes across a range of industries, geographies and development stages. Here we explain what venture capital investing is, how it fits into a well-balanced private investor portfolio, and how to access the best-performing venture capital funds.

What is venture capital?

Venture capital (VC) is concerned with investing in companies at the very earliest stages of their growth journey. This may be as early as inception stage and before profits have been achieved. By contrast, private equity predominantly focuses on more established and profitable companies. As such, venture capital presents a very different risk/return profile from private equity investments.

Venture capital investors take stakes in start-up and early-stage companies with exponential growth potential. Those companies use that investment to kick-start or turbocharge their nascent growth, enabling entrepreneurs to turn their ideas, proofs of concept or prototypes into viable, profitable businesses, often within ambitious timeframes.

Investors are looking for innovative businesses that have what it takes to grow rapidly, carving out new niches or seizing market share from industry incumbents, or disrupting sectors altogether. These businesses often struggle to obtain bank lending, as they may not yet be profitable or have consistent revenue streams.

Venture capital investing can take place at different stages along a company’s early development journey. These are:

Seed-stage investing

Seed investments typically happen at the start-up stage, before the company is revenue-generating. Seed capital enables companies to refine their concept, conduct market research and plan the business model. The capital usually comes from accelerators, incubators, “angel investors” (high net worth individuals), crowdfunding, or from the founder themselves and their friends/family.

Series A investing

This is typically the first funding round in which venture capital funds, operated by professional investment managers, commit capital, as the company starts to generate revenue. Series A capital tends to be used for further product development and initial market roll-out, as well as for marketing and advertising, and to hire more staff, including broadening out management teams.

Series B investing

This where capital is used to start to scale the business. It is often used to expand product manufacturing or service delivery, create dedicated marketing or sales teams, and extend market penetration. By now businesses should be able to measure their performance and accurately predict their future growth trajectory.

Series C investing

Series C is usually where capital is used to accelerate growth, by developing new products, scaling up teams, consolidating and growing the customer base, and/or expanding into new markets. By this stage, the company should have a consistent, growing revenue stream, and could be ready to gear up to take on private equity investment or bank lending to fund the next stage of growth.

Why invest in venture capital?

Due to their early stage, venture capital investments can be high risk. But while the failure rate can be higher than it is for more mature businesses, the potential rewards for those companies that do succeed are also much higher.

Technology is a key area of focus, given the fast-changing nature of the tech sector and the potential for emerging areas such as artificial intelligence (AI) to become the “next big thing”. Many of the biggest names in tech, such as Google and Facebook started out with VC funding. However, many other sectors such as healthcare, financial services, consumer goods and energy are also major recipients of significant VC investment (examples include Revolut, Interactive Investor, Monzo, The Hut Group, Just Eat and Oxford Nanopore).

Investing in venture capital provides investors with exposure to investments that can deliver high risk-adjusted returns from backing exciting and innovative business ideas and technologies. In short: to enable the standout brands of the future to get off the ground and ultimately reach their potential. Imagine being an early backer of Deliveroo, Zoom, Peloton or Klarna. Without VC funding, they would not exist.

When these companies take off, the potential returns that can be generated are substantial. For example, one of the first investors to participate in Zoom’s 2011 initial funding round achieved a 200x return1. Seed investors in Airbnb saw a 499,900% return just over a decade later on its IPO in 20202. Clearly not all VC investments will go this stratospheric – and some will fail altogether - so it’s especially important here to consider spreading risk across a variety of investments by investing via a fund (as we discuss in more detail in the next section).

Even a small allocation to venture capital can have an important part to play in an investor’s portfolio performance. The exact proportion will depend on each individual investor's risk appetite, investment goals, timeframe, and existing portfolio composition.

How to invest in venture capital

One of the best ways to invest in venture capital is through a diversified fund, with risk spread across multiple underlying companies. Venture capital funds are run by specialist fund managers that pool capital from a range of investors, and then seek out suitable investment candidates which meet their specific criteria.

VC fund managers invest relatively small amounts in a wide range of companies, in the expectation that they will back some stellar performers which could deliver outsize returns to mitigate risk and drive impressive returns for the fund overall. As a general rule, VC fund managers expect only around a third of their portfolio assets to succeed3. So, investing via a fund means that your capital allocation will be spread across a wide range of investment opportunities, ensuring you’re not “putting all your eggs in one basket”, and maximising the chances of success.

Manager selection is extremely important here. Investors need to know that the fund they are considering is run by top-tier managers with a proven track record of performance investing in these types of businesses. Those managers should have the networks to identify a good selection of potential opportunities and the skills to spot the best ones following thorough due diligence. They should also have the expertise to support portfolio companies at this stage of their growth, practically as well as financially, in order to maximise value creation. Managers often play an active part in their portfolio companies, offering guidance or taking a hands-on role, and usually taking a seat on the board.

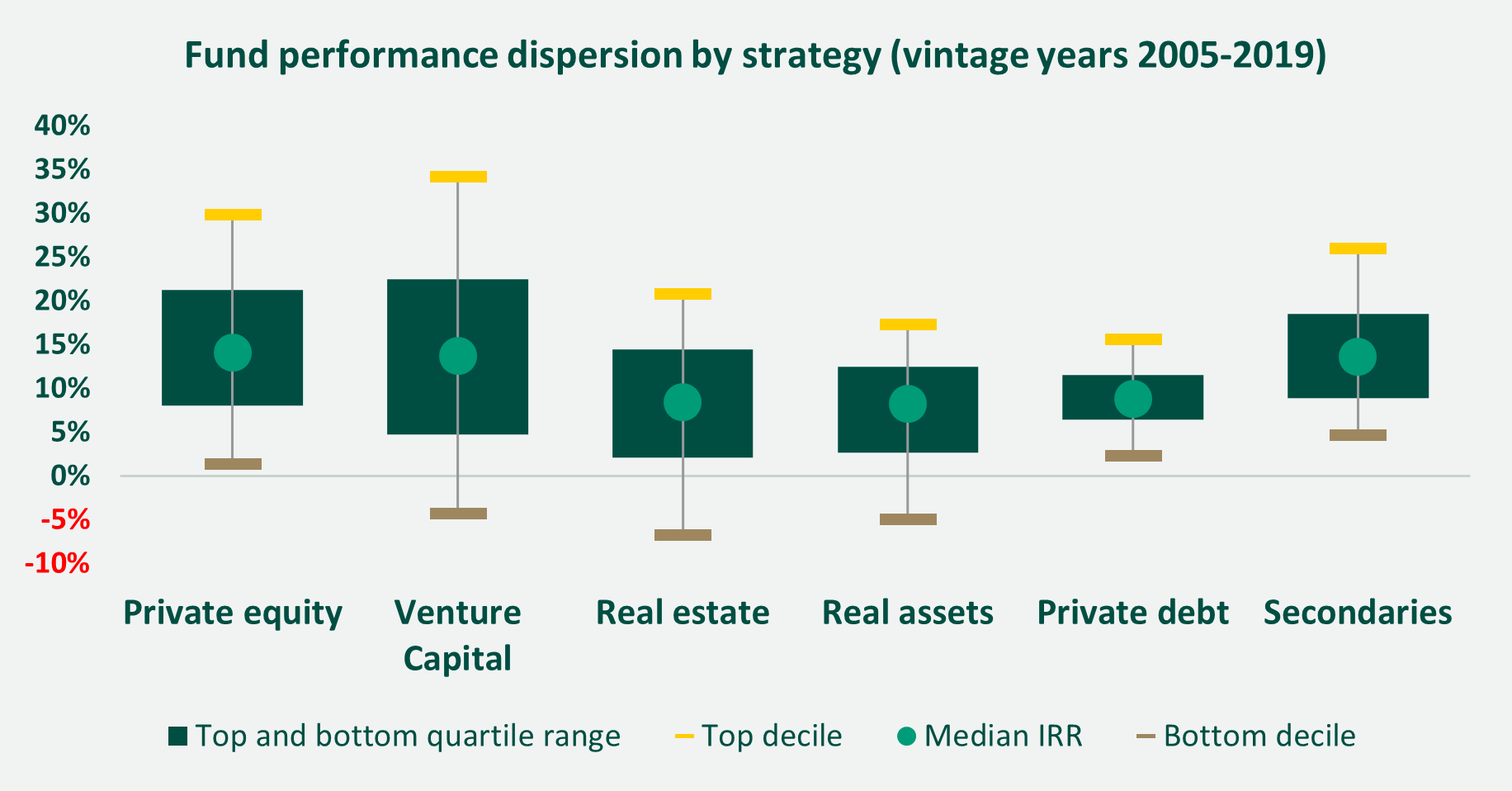

Manager selection matters in all private equity investments, but the difference between investing with a top-quartile fund manager and a bottom-quartile one is particularly striking in the VC arena, as we can see from this chart (geography global, as at 31 March 2024)4:

Primary and secondary VC funds

Investors can participate in primary or secondary VC funds. Primary VC funds are where the VC fund manager uses capital committed by a range of investors to buy newly issued shares in a company, which then uses the capital to fund development and growth (as outlined above).

In secondary funds, secondary fund managers buy out the shareholdings of primary fund managers (known as GP-led transactions) or those investing in their funds (known LP-led transactions), providing existing investors with liquidity. Because companies are more mature at this stage, risk is reduced and exits are closer, shortening the returns timeframe.

This flexibility and option for liquidity is another reason why VC funds are attractive: the secondary market for VC investments made through other investment vehicles such as venture capital trusts (VCTs) or via routes such as crowdfunding are extremely limited or non-existent.

How to gain access to VC funds

VC funds are generally the preserve of institutional investors such as pension funds or sovereign wealth funds, due to the high investment minimums required – typically in the region of at least £1m, putting them out of reach of most private investors.

Connection Capital provides a solution to this problem. Those who invest in the opportunities we present can do so in units of just £25,000, and we pool commitments together to meet those minimums, acting as an institutional investor on clients’ behalf. Not only does this make this asset class accessible, it facilitates portfolio diversification. We only work with top-tier managers, and our reputation and track record in the market mean we have a strong network of managers in this space with which to invest.

You can register with Connection Capital here to receive notification of future venture capital and other private market investment opportunities.

Register to view venture capital investment opportunities

Please note:

Past performance is not a reliable indicator of future performance. Investments in venture capital are high risk and speculative which means there is no guarantee of returns and investors should not invest unless they are prepared to lose all of their money. This type of investment is illiquid so can’t be easily accessed until the exit point. The investor is unlikely to be protected if something goes wrong. More information is given on our risk warnings page here .

Sources:

- Forbes, forbes.com/sites/jackkelly/2022/12/05/early-venture-capitalist-investor-in-zoom-with-a-200x-return-offers-his-views-on-the-future-of-the-startup-space/

- Yahoo, finance.yahoo.com/news/early-airbnb-investors-raked-499-193618823.html

- Deutsche Bank, deutschewealth.com/en/insights/investing-insights/asset-class-insights/venture-capital-investing-closer-look/portfolios-venture-capital.html

- Pitchbook, Q1 2024 Global Fund Performance Report (with preliminary Q2 2024 data).